Feb 12, 2026

Client Profile

A Web3-native remittance provider focused on high-frequency retail payouts, starting with the USD–INR corridor.

The company processes nine-figure annual volumes and competes on speed, reliability, and pricing transparency. As demand accelerated, the team prepared to scale aggressively and expand into GBP and EUR corridors, without compromising instant payout guarantees.

The Constraint Was Settlement Behavior

The business had a strong product–market fit. Demand was not the limiting factor.

What constrained scale was settlement latency — the structural delay between payout execution and underlying settlement across banks, on/off-ramps, and FX rails.

Before Zynk:

Weekday settlements took ~2 days; weekends extended to ~4 days

Payouts were gated by bank cut-offs and partner SLAs

Instant payouts required capital to be pre-positioned ahead of settlement

Treasury teams actively managed liquidity buffers, FX exposure, and timing risk

As volumes grew, payout finality remained tightly coupled to settlement finality. Scaling meant financing that delay with increasing amounts of capital.

The team faced a clear choice:

Scale the balance sheet to match settlement lag and remove settlement lag from the system.

Why Existing Models Broke Down

Traditional approaches attempted to work around settlement latency:

Banks and local rails settled slowly and corridor-by-corridor

Pre-funding scaled linearly with volume

Working capital facilities added fixed costs to variable flows

OTC execution and on/off-ramps introduced pricing opacity and operational drag

Despite their differences, these models shared one assumption:

Payouts must wait for settlement — or be financed until it completes.

What the client needed was not a new rail, partner, or liquidity source.

They needed instant settlement as a platform capability.

Zynk: An Instant Settlement Layer

Zynk is an embedded settlement layer that guarantees instant payout finality at the transaction level — independent of when underlying rails settle.

It integrates behind existing banks, PSPs, and on/off-ramps, and changes how settlement behaves without requiring changes to customer-facing flows.

Liquidity is embedded as an internal mechanism — not exposed as a product. It exists solely to uphold Zynk’s instant settlement guarantees while underlying systems settle asynchronously.

As a Result, Zynk:

Decouples payouts from bank and rail settlement timelines

Removes the need to pre-fund corridors

Abstracts settlement complexity away from treasury and operations

Zynk can sit on your existing rails with embedded liquidity.

It replaces settlement latency as a constraint.

Deployment

Phase 1 – Validation

USDT → INR flow

Integrated via Zynk’s settlement layer

Live testing completed in ~1 week

Phase 2 – Production Rollout

USD on-ramp → INR off-ramp coverage

One-time integration with Zynk, compatible with supported on-ramp partners

Instant settlement behavior extended across live production payouts

Full rollout completed in ~2 weeks

From the Client’s Perspective

No pre-funding requirements

No OTC execution

No changes to the customer payout experience

Only settlement behavior changed.

Results

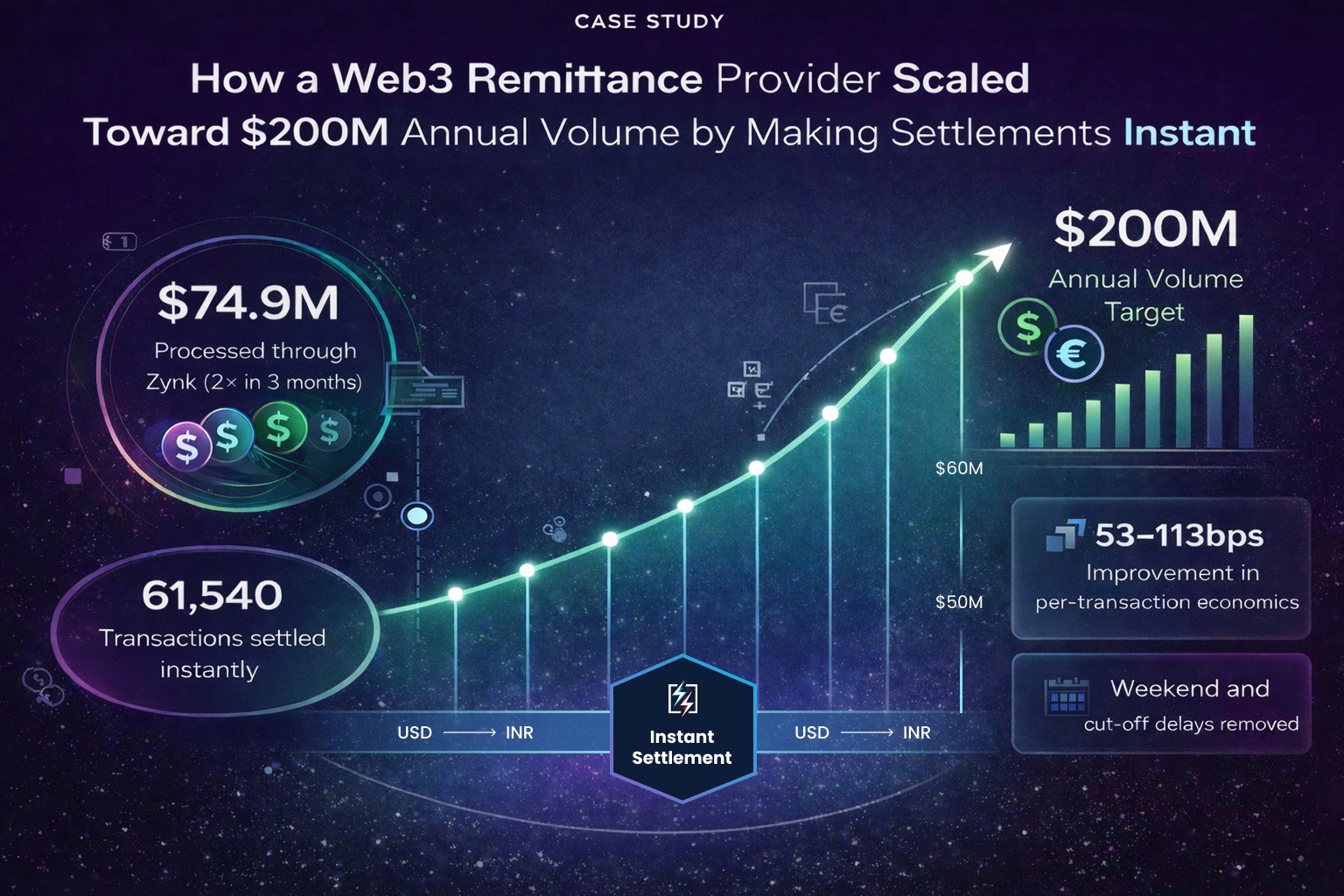

$74.9M

Processed through Zynk (2× in 3 months)

61,540

Transactions settled instantly

53–113 bps

Improvement in per-transaction economics

Fully Abstracted

Weekend and cut-off delays removed

What Changed at Scale

The client’s target was ~$200M in annual volume.

Under traditional models, maintaining instant payouts at that scale would require millions of dollars locked purely to bridge settlement delays.

With Zynk, settlement no longer required capital to be held ahead of demand. Growth stopped being limited by balance-sheet mechanics and treasury coordination.

Settlement became infrastructure — not something the business had to finance.

Why This Matters

This case was not about optimizing liquidity or switching rails.

It demonstrated that instant settlement can exist as a platform primitive — even when underlying financial systems remain slow.

With Zynk, the client can now scale volume, expand corridors, and operate continuously without restructuring its balance sheet around settlement timing.

From the CEO

“Zynk didn’t change how we move money — it changed what constrained us.

Settlement stopped being a balance-sheet problem and became infrastructure.”